Apple Pay is growing in popularity because of how accessible and versatile it is. You may be interested in learning more about payments through this service for a variety of reasons. For anyone using a range of Apple devices, understanding this popular payment method is extremely beneficial.

So, what is Apple Pay?

With Apple Pay, users are able to make payments, manage money, and perform a multitude of actions. This payment method is widely used for a broad range of payment opportunities, adding to the spectrum of possibilities.

Apple Pay is a digital payment method designed by Apple Inc. for Apple devices. Although it is available on Apple products, many businesses and services accept this method of payment. The acceptability of Apple Pay is often a major area of concern for users, so it is important to know if this method will be an accepted form of payment for any future purchases.

Because it is digital, Apple Pay may be used in-person and online, with the added feature of contactless payment. Users can securely view their payments, cards, and history with this easily accessible method.

How does Apple Pay work?

This system is widely popular because of its flexibility and security, which appeals to many users. With the added benefits of contactless payment to ensure safety, and stress-free payment processes, Apple Pay is simple and secure.

A major aspect of Apple Pay that appeals to so many users is that it is completely digital. You will be able to make payments through your Apple device or devices, instead of holding onto physical cards.

Users are able to easily access payment cards, including credit cards, through the Wallet app. The technology used for the Wallet app stores information in a secure way in order to prevent risks with privacy. An important note is that your information is not used without your permission, which is an aspect of Apple Pay that users should be aware of and monitor as needed.

Each time you make a purchase, the safety of your information is a top priority. In order to keep your payments secure, the technology of Apple Pay makes it harder for possible dangers to jeopardize your payments or credit stability. Card numbers are secured within NFC systems in order to prevent risks that may result in a need for credit repair. This means that you can feel confident anytime you use this digital payment method.

Improving your credit score with Apple Pay

During any process of trying to repair your credit, understanding the most easy and effective methods to do so is always important.

Apple Pay offers added benefits of possibly fixing your credit, without the hassle of contacting credit repair services. Paying your bills is one major stressor that becomes less troublesome, allowing you to notice greater improvements as you check your credit.

The features of Apple Pay are not just limited to your devices. With quick updates and secure systems, you can keep track of your payments at all times. Having your payment history available in a secure and easily accessible way makes checking for errors on your credit report, for example, a painless process.

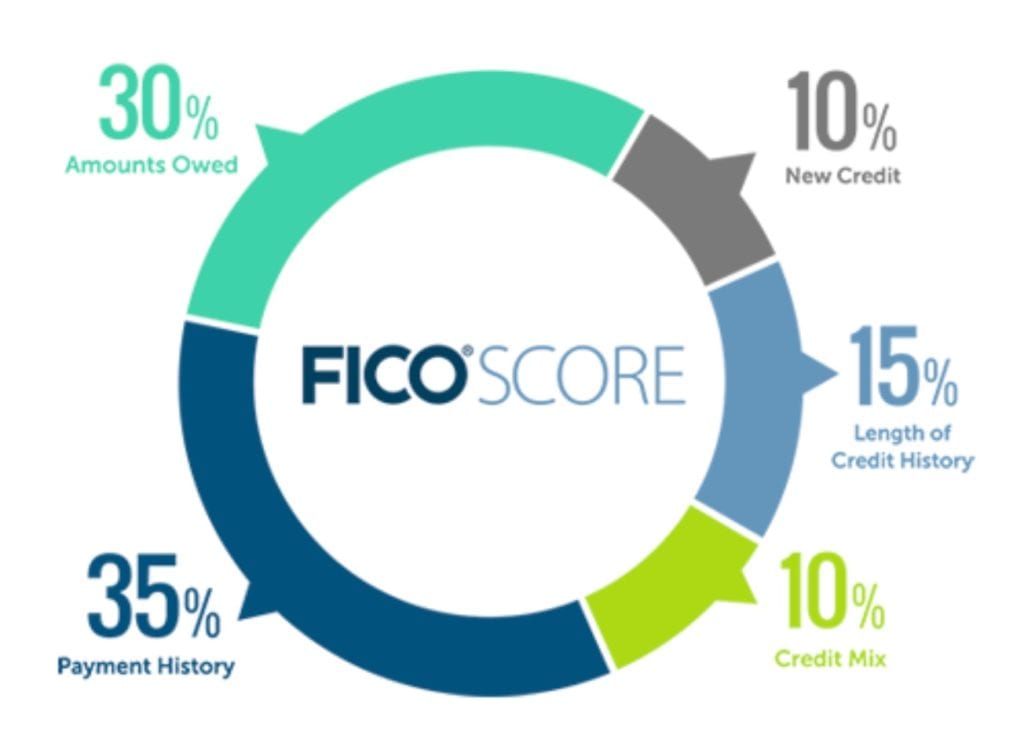

The Wallet app also lets you access and manage payment cards, including credit cards, easily. By managing your different payment cards, you can monitor and maintain a good credit mix. This can also help make interest rate and credit monitoring a simpler process throughout daily life.