Do you have unpaid bills that have gone to collections? If so, you are in the company of over 60 million other Americans with the same problem. And if you are being contacted by debt collectors, you may have noticed Medicredit phone calls, or seen the name on your credit report. Know that debt issues like this can happen to anyone, but it hurts your credit score. And contact from debt collectors can be annoying and confusing if you don’t know what to do. If you are ready to fight back against this debt collector, we’ll show you how to remove Medicredit, Inc. from your credit report in 3 simple steps.

Is Medicredit, Inc. A Legitimate Business?

Medicredit, Inc. is a collection agency with headquarters in St. Louis, Missouri. The company was founded in 1977, and has been accredited with the Better Business Bureau since 2016. Their job is to collect unpaid debts for doctors, hospitals and healthcare facilities. Medicredit is a legitimate business working with creditors to recoup old debts.

Medicredit, Inc. address:

111 Corporate Office Drive, Suite 200

Earth City, MO 63045-1506

Why Is Medicredit On My Credit Report?

If Medicredit is on your credit report, it is because they have purchased an old unpaid debt that they believe you own. But this may not be the first time you have seen Medicredit, since there is a process to follow before they report the account on your credit report.

First, Medicredit informs the owner of a debt that they owe money. Then if there is no response in 30 days, Medicredit begins other methods of contact, like phone calls. If there is no response after calls, the report is sent to the three credit bureaus and it becomes part of the debtor’s credit record. If it reaches your credit report, it’s time to get started with the three simple steps to delete this collections account.

Your Consumer Rights

Before you start, know your consumer rights when dealing with debt collectors. The Fair Debt Collection Practices Act states rules and laws that Medicredit has to follow. For example, Medicredit can’t call you before 8 a.m. or after 9 p.m. Medicredit can’t call you at work, or use abusive language or threaten you in any way. And, Medicredit cannot threaten to sue you. You have a right to contact the Consumer Finance Protection Bureau and file a complaint if they violate any of these laws.

Step 1: Validate The Debt

It is also your right to know why Medicredit is coming after you for a debt. As a savvy consumer, never pay a debt unless you know it’s valid, so first you must be sure the debt is indeed yours. You also need to verify that you owe the amount they claim you owe. This is called validating the debt.

To validate the debt, use this free debt validation template letter and mail it to Medicredit via USPS certified mail.

Step 2: Dispute The Debt

If Medicredit has reported your debt to credit bureaus, you need to be sure and check for any errors in the debt validation that Medicredit sends you. Here are some things to double check:

Is the name accurate?

Is the debt amount correct? (Maybe you’ve paid the debt already, and they did not record your payment.)

Did you actually have an account with the original creditor?

These are important questions to consider. If you find any errors in the information they have sent, You can dispute the debt. Use this free debt dispute letter from CambioMoney, and mail it via USPS certified mail to all three credit bureaus. Also, mail a copy of the dispute to Medicredit, Inc.

Step 3: Make A Deal – Pay For Delete

If you are sure that you owe this debt, you can start to make a deal to pay part of the amount. Remember, you can negotiate with Medicredit to pay a portion of the debt and have it resolved. Many consumers find 30-40% of the debt amount is a good place to start negotiating. Think about what you can afford to pay, and do not offer to pay more.

If you are able to pay the debt, ask Medicredit for a pay for delete arrangement. You agree to pay whatever you can, as long as they agree to remove it from your credit history. Be certain that any amount you negotiate is the amount that you will actually pay so that you are carrying out your part of the promise. And most important of all, if they agree to your terms, get the deal in writing before you make any payment.

Other Options

If Medicredit does not agree to a pay for delete arrangement, you can ask to make small monthly payments. And if you pay consistently, it’s a smart strategy to ask if Medicredit will change your account status on your account to “paid collections.” This is a more positive remark than an “unpaid” status on your credit history.

Get Help Negotiating with Medicredit, Inc.

Talking to debt collectors can cause stress, but there’s no need to be afraid. If you are hesitant to work directly with them, the CambioMoney app can help. Our experience dealing with collection agencies means we are able to help come up with solutions for consumers to finally pay off their debt and improve their credit score. If you want support, Cambio can help you negotiate a favorable solution for both you and a debt collector.

From Collections To Credit Recovery

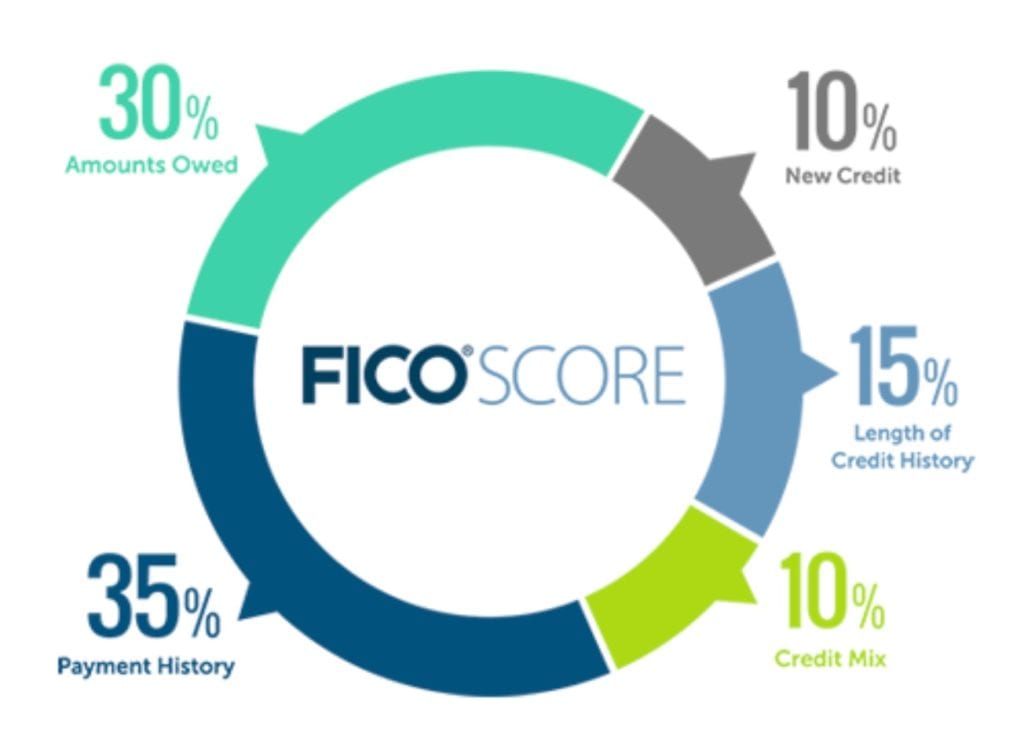

Now that you have the tactics you need to deal with Medicredit, you can start your journey toward credit recovery. There are a few ways to keep Medicredit and other debt collectors from tanking your credit score ever again. The first is to make timely payments. Be sure that you can afford new loan payments or credit card payments before you apply for them. Use credit sparingly. And, it’s important to regularly check your credit report for any errors. If you see mistakes, quickly dispute them so that your score doesn’t drop.

It’s time to take action! You can begin with these 3 simple steps to delete Medicredit, Inc. from your credit report today. Remember: know your rights, request verification, dispute errors, negotiate removal, and keep an eye on your credit score. There’s no need for bad collections accounts to pull your score down. You can build a better credit score and the solid financial future you deserve.