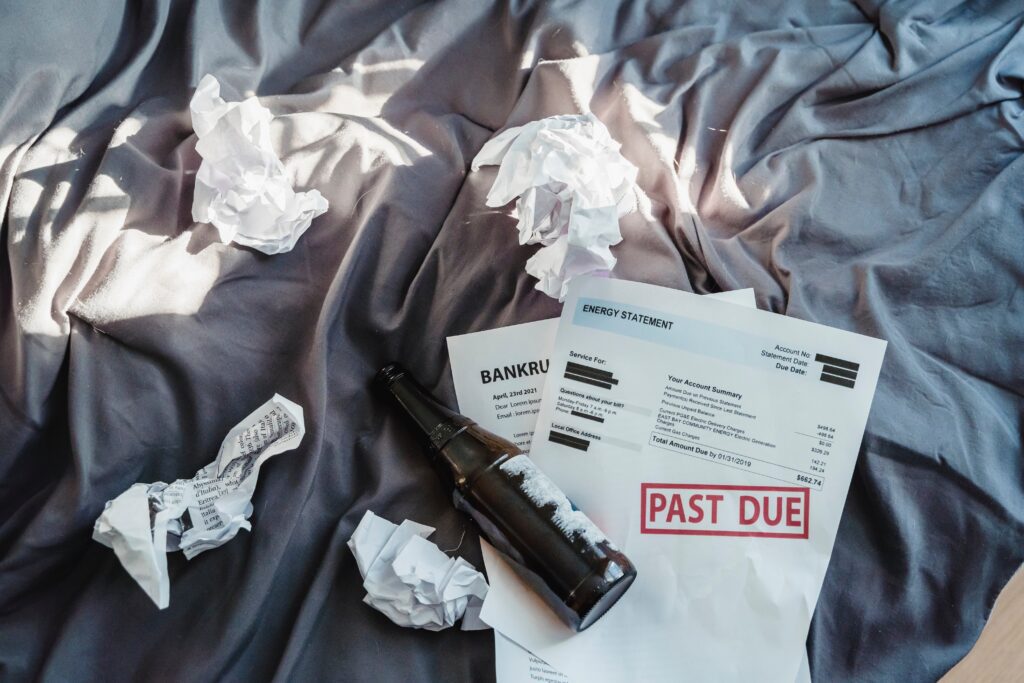

If you are notified that your wages will be garnished, you may wonder what the best course of action is. Facing the process of wage garnishment can be stressful and overwhelming. You could fight the garnishment on your own, or you could call on an expert attorney who can give you options to address the situation. This article will explore how a wage garnishment attorney can help you avoid wage garnishments, and manage or reduce debts that could result in garnishments.

We’ll explain the role of an attorney in guiding you through the process.

What is Wage Garnishment?

First of all, let’s lay out what wage garnishment is and how it works. Wage garnishment is a way for government entities or private creditors to collect money when they need to recover unpaid debts. It means that a creditor can claim a portion of your earnings to pay off the debt. If a creditor has won a judgment in a suit against a consumer, then they can proceed with garnishing wages. This means that money will be taken from a portion of your wages to pay a debt.

Wage garnishment has financial implications and can really set your credit back. If you are facing garnishment, this article will explain how a wage garnishment attorney can help you.

What Kinds of Debt Result in Garnishment?

These are several common types of unpaid debts that may result in garnishment.

- Alimony or spousal support

- Child support

- Student loan in default

- Unpaid taxes

- Unpaid auto loans

- Unpaid credit card debt

How Does Wage Garnishment Work?

The U.S. Department of Labor oversees the garnishment process to enforce the Consumer Credit Protection Act’s Title III. This law sets restrictions on the portion of your income that can be garnished. It also protects you from being fired from your job because of a garnishment order. Basically, if a creditor wins the right to garnish your wages, then an amount from your paycheck is automatically sent to pay the creditor until your debt is resolved.

Garnishment to Pay A Judgment

It can help to understand that there are two types of garnishment. One is when a creditor garnishes wages to pay a judgment it won in court against you. The creditor files documents with the court, and asks them to force your employer to send your earned wages to them to pay off your debt.

Administrative Wage Garnishment

Second, there is administrative wage garnishment. This is when a creditor garnishes your wages without winning a judgment. For child and spousal support debts, the law usually requires these are collected via administrative wage garnishment. Depending on your state, the government can garnish between 25 – 65% of your wages to satisfy child or spousal support debts.

Another example of debts that are often paid through an administrative wage garnishment are state or federal taxes and student loans.

How a Wage Garnishment Attorney Can Help You Avoid Garnishment

If a creditor sues you for defaulting on a debt, an experienced wage garnishment attorney is your best chance at a solid defense. An attorney will also help you file an answer to a creditor’s complaint. If the judge rules against you in the suit, the attorney may be able to help reduce the amount you owe.

Second, a wage garnishment attorney has in-depth knowledge of federal and state laws regarding garnishment exemptions. They can identify if any exemptions apply to your specific situation, such as certain types of income that are protected from garnishment– for example Social Security income. This can be crucial in preventing part of your wages from being garnished.

Third, an attorney is a valuable help to review and make sense of the creditor’s claims. They can determine if the creditor violates the statute of limitations, and they are skilled at spotting fraud or identity theft. By identifying these issues, they can leverage them in your defense and protect your rights. They will also help ensure that the creditor acts in line with the Fair Debt Collection Practices Act, and does not use unlawful collection practices.

If you think you may want to hire an attorney, many offer a free consultation to determine if they can help in the case of your lawsuit.

How an Attorney Can Help You Negotiate

In many cases, a creditor will prefer to settle out of court to avoid the time and expense of the process. To avoid going to court, your attorney may negotiate a debt settlement before the case goes to trial. As a matter of fact, it’s even better if you can reach a settlement before a lawsuit is filed. A skilled attorney will have a sense of what offer the creditor is likely to accept.

In the event that you go to court and lose your case, an attorney will make sure that the creditor doesn’t exceed the allowed limits. There are laws to protect your rights once a judgment is entered against you. For instance, the Consumer Credit Protection Act’s 15 U.S. Code §1673(a) prohibits the creditor from taking more than 25 percent of your disposable earnings or the amount that is more than 30 times the federal minimum wage, whichever is less. Your attorney will help you calculate the maximum amount the creditor can garnish.

An attorney can help you proactively explore strategies like debt settlement, ensuring legal compliance, and considering bankruptcy when facing multiple debts. They will assist you in finding the best way to resolve your particular debt situation.

Hiring an Attorney to File a Bankruptcy Petition

If bankruptcy is the best solution for managing your debt, an attorney can guide you through the process. Under the Bankruptcy Code, consumers have two primary options: Chapter 7 bankruptcy and Chapter 13 bankruptcy. Both chapters provide immediate relief from wage garnishments through the automatic stay.

Chapter 7 bankruptcy offers a quick resolution, and lasts 4-6 months. In most cases, filers keep their assets. Instead, the primary outcome of a Chapter 7 bankruptcy is the elimination of debt.

For debts where Chapter 7 bankruptcy is not possible, Chapter 13 bankruptcy comes into play. This includes car loans, mortgages, and certain non-dischargeable debts like tax debts. Chapter 13 involves a structured payment plan over 36-60 months. This is an option when Chapter 7 is not feasible. An attorney can assess your situation and determine which chapter best suits your needs.

While you can file for bankruptcy without an attorney, it is not advisable to go through the process independently. If you have assets or a home, or if you earn above a certain income, your case will be complex. An attorney will be required to make sure you have the best outcome.

Whether it’s Chapter 7 or Chapter 13, an attorney’s expertise can ensure a smoother process and a path towards debt relief.

Summing it up

Consulting with a wage garnishment attorney can help you gain an understanding of your rights and options. They will assess your unique circumstances and provide personalized guidance. This might be helping you avoid wage garnishment by settling the debt. Or it may be finding a different resolution that suits your needs. Hiring a wage garnishment attorney may be costly, but it can make a big difference in your ability to protect your income and financial stability. A wage garnishment attorney is invaluable to help you find the optimal solution for your particular debt circumstances.