Dealing with credit card debt can be a stressful and overwhelming experience. As your debt piles up, so do the consequences, including late fees, high-interest rates, and damage to your credit score. In such scenarios, a credit card debt lawyer can provide the necessary legal assistance to help you regain control of your finances.

In this blog post, we’ll explore the role of a credit card debt lawyer, what they can do for you, and how to find the right one for your specific needs.

What is a Credit Card Debt Lawyer?

A credit card debt lawyer is a legal professional specializing in consumer debt and bankruptcy law. These attorneys assist clients in navigating the complexities of credit card debt, negotiating with creditors, and, if necessary, filing for bankruptcy. Their expertise in these areas can help you find the best possible solution for your financial situation.

How Can a Credit Card Debt Lawyer Help?

A credit card debt lawyer can offer several services depending on your specific needs:

1. Debt Negotiation

One of the primary services offered by a credit card debt lawyer is negotiating with your creditors on your behalf. They can discuss reducing the outstanding balance, lowering interest rates, or waiving late fees to create a more manageable repayment plan. A skilled lawyer may even be able to secure a lump-sum settlement that can significantly reduce your debt.

2. Debt Consolidation

A debt lawyer can also assist with debt consolidation. A process that combines multiple credit card debts into a single loan with a lower interest rate. This can make it easier to manage your payments and ultimately reduce the amount of interest you pay over time.

A lawyer can help you evaluate consolidation options and negotiate favorable terms with lenders.

3. Bankruptcy

If repaying your credit card debt is not feasible, a debt lawyer can help you explore the option of filing for bankruptcy.

Bankruptcy is a legal process that can eliminate or restructure your debts under court supervision, providing a fresh financial start. An experienced attorney will guide you through the bankruptcy process, helping you determine which type of bankruptcy is most suitable for your situation.

4. Defending Against Lawsuits

If a creditor files a lawsuit against you for unpaid credit card debt, a lawyer can represent you in court and help protect your rights.

They can challenge the validity of the debt, negotiate a settlement, or present a defense that may result in a dismissal or reduction of the amount owed. With a skilled attorney on your side, you can increase your chances of a favorable outcome in court.

5. Credit Counseling and Financial Education

Many credit card debt lawyers also offer credit counseling and financial education services.

They can help you better understand your financial situation, identify the underlying causes of your debt, and develop strategies for managing your finances moving forward.

This knowledge can be invaluable in preventing future debt issues and maintaining long-term financial stability.

6. Stopping Creditor Harassment

Debt lawyers can also help put an end to creditor harassment.

If creditors or collection agencies are engaging in aggressive or illegal tactics to collect a debt, an attorney can intervene on your behalf. They can ensure that your rights under the Fair Debt Collection Practices Act (FDCPA) are protected and take legal action against creditors if necessary.

7. Protecting Your Assets

A lawyer can help you protect your assets from seizure or garnishment by creditors.

They can advise you on which assets may be exempt from collection and help you take the necessary steps to safeguard your property. This can provide you with peace of mind and financial security during a challenging time.

8. Navigating Complex Legal Procedures

Dealing with credit card debt often involves navigating a complex web of legal procedures, regulations, and paperwork.

A credit card debt lawyer can simplify this process by handling the legal aspects of your case and ensuring that all necessary steps are taken.

Their expertise can save you time, stress, and potential mistakes that could hinder your debt relief efforts.

How to Choose the Right Credit Card Debt Lawyer

To find the right credit card debt lawyer, it’s important to do your research. Here are some factors to keep in mind:

1. Experience

When searching for a credit card debt lawyer, prioritize finding an attorney with significant experience handling cases similar to yours. This will ensure they possess the necessary knowledge and skills to effectively represent your interests.

Make sure to ask about their success rate in resolving credit card debt cases and their familiarity with relevant laws and regulations.

2. Reputation

A lawyer’s reputation is an essential factor in your decision-making process. Research their reputation by reading online reviews, checking their standing with the local bar association, and asking for recommendations from friends, family, or other legal professionals.

A reputable attorney will have a strong track record of successful outcomes for their clients and a history of ethical conduct.

3. Communication

Effective communication is critical when working with a debt lawyer. Choose an attorney who is responsive, communicates clearly, and takes the time to explain your options and answer your questions. This will make it easier for you to understand the legal process and make informed decisions throughout your case.

4. Fees and Payment Structure

Before hiring a credit card debt lawyer, inquire about their fee structure and payment options. Some lawyers offer flat fees, hourly rates, or work on a contingency basis (where they only collect payment if they win your case).

Be sure to discuss any additional costs, such as court filing fees or expert witness fees, so that you understand the full extent of your financial commitment.

5. Specialization

Consider whether the attorney specializes exclusively in credit card debt, or if they practice in other areas of law as well. A lawyer who focuses solely on credit card debt cases may have a deeper understanding of the complexities and nuances of this specific area of law.

However, an attorney with a broader practice might offer a more comprehensive approach to resolving your financial difficulties.

6. Compatibility

Choosing a lawyer with whom you feel comfortable and can establish a trusting relationship is essential. Schedule an initial consultation to get a sense of their personality, communication style, and approach to handling cases.

You will likely be working closely with this person for an extended period, so finding someone you can work with is important.

7. Location

Consider the location of the credit card debt lawyer’s office, as this may affect your ability to meet with them in person.

A local attorney will likely have a better understanding of your area’s specific laws and regulations, as well as established relationships with local courts and creditors.

However, don’t limit yourself to a geographic location if you feel a lawyer from another area is better suited to handle your case.

8. Support Staff and Resources

Finally, take note of the lawyer’s support staff and the resources they have at their disposal.

A well-staffed law firm with access to expert witnesses, paralegals, and other legal professionals can be beneficial in building a strong case for your debt relief efforts. Ask about the experience and qualifications of the staff and how they will be involved in your case.

Understanding Your Rights and Options in Credit Card Debt Relief

It’s important to remember that the resources of a credit card debt lawyer are meant to help you understand your rights and options when it comes to resolving your financial difficulties.

It’s in your best interest to work with an experienced professional who can provide sound advice, clear communication, and comprehensive legal representation that speaks directly to your needs.

The Fair Debt Collection Practices Act (FDCPA)

It’s a law that regulates the actions of creditors and debt collectors to protect consumers from unfair, deceptive, or abusive practices.

It’s essential to understand your rights under the FDCPA, as it can help you recognize when a debt collector is overstepping their bounds. A debt lawyer can ensure that your rights under the FDCPA are upheld and take action against any violations.

Statute of Limitations

Each state has its statute of limitations, which determines the time frame within which a creditor can legally pursue a debt. If the statute of limitations has passed, the creditor may no longer have the right to collect the debt or file a lawsuit.

A debt lawyer can help you determine whether the statute of limitations has expired and use this information to your advantage in negotiations or legal proceedings.

Debt Validation

Debt validation is a process that requires a debt collector to provide proof of the debt they claim you owe. Upon request, the collector must provide documentation that verifies the debt’s legitimacy and the specific amount owed.

A lawyer can guide you through the debt validation process, ensuring that the debt collector provides the necessary information.

Debt Settlement vs. Debt Management Plans

These plans are two common strategies for addressing credit card debt. Debt settlement involves negotiating a lump-sum payment with your creditors, often for a significantly reduced amount.

In contrast, a debt management plan involves working with a credit counseling agency to develop a structured repayment plan. A credit card debt lawyer can help you evaluate these options and determine the most suitable approach for your situation.

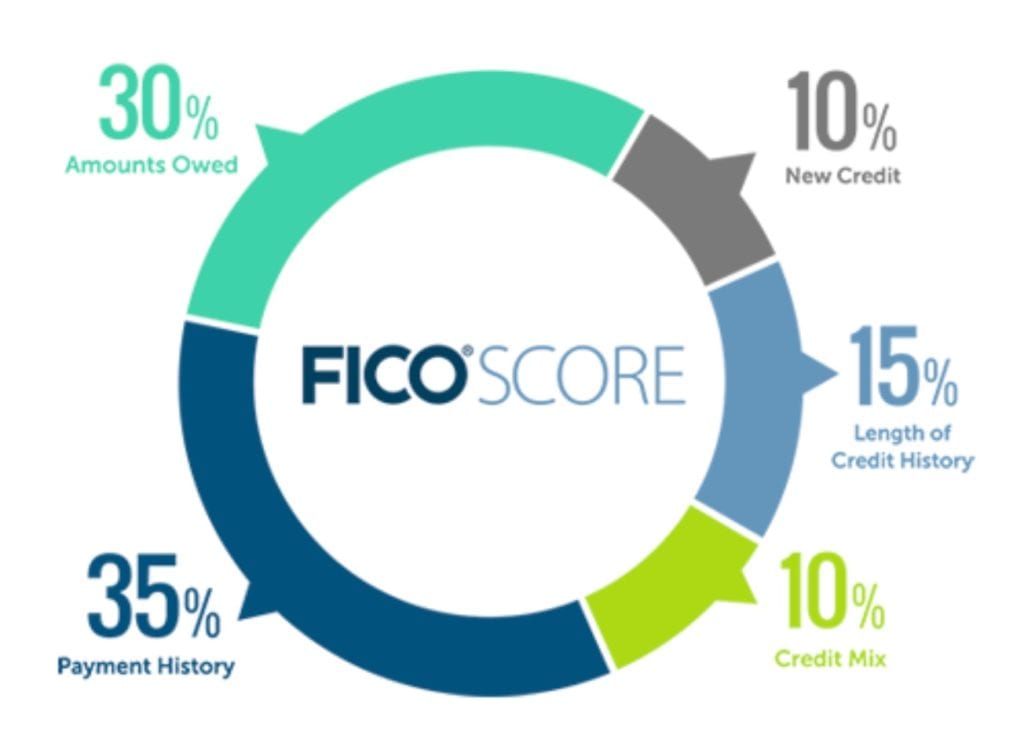

Assessing the Impact on Your Credit Score

Your credit score can be significantly impacted by credit card debt and the actions you take to resolve it.

Bankruptcy, debt settlement, and missed payments can negatively affect your credit score.

A debt lawyer can help you understand the potential impact of various debt relief strategies on your credit score.

Tax Implications of Debt Relief

Debt relief efforts can have tax implications, such as the potential for canceled debt to be considered taxable income. It’s crucial to understand the tax consequences of your chosen debt relief strategy and plan accordingly.

A credit card debt lawyer can provide guidance on the tax implications of your debt relief efforts and help you make informed decisions.

Fraudulent Debt and Identity Theft

If you suspect that your credit card debt is the result of fraudulent activity or identity theft, it’s essential to address the issue promptly.

A debt lawyer can help you dispute fraudulent charges, work with credit bureaus to correct inaccuracies, and take legal action.

Preventing Future Debt Issues

Finally, a credit card debt lawyer can provide valuable advice and guidance on preventing future debt issues.

They can help you develop a budget, create a plan to save and invest, and identify strategies for using credit responsibly. You can build a more secure financial future by learning from your past mistakes and adopting healthy financial habits.

Final Thoughts

Dealing with credit card debt can be a daunting and stressful experience, but you don’t have to face it alone. A lawyer can provide the expertise, guidance, and support you need to navigate the complexities of debt relief. You can work toward a brighter financial future by understanding your rights, exploring your options, and choosing the right attorney.

Remember that each situation is unique, and the best course of action depends on your circumstances. A credit card debt lawyer will tailor their approach to your needs, ensuring that you receive personalized legal assistance.

The key is to take action ASAP. The sooner you address your debt issues, the more options you will have for resolving them. Don’t let credit card debt control your life. Reach out to a qualified credit card debt lawyer today and take the first step toward financial freedom.