How do credit card points work? A guide

Credit cards often have rewards programs tied to your account. These points allow you to earn rewards based on your spending habits.

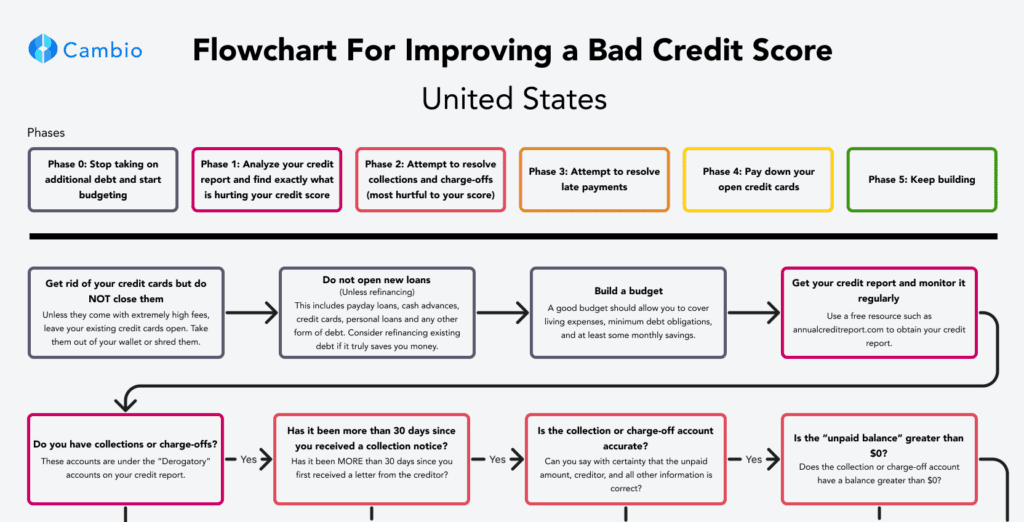

Everything you need to jumpstart your credit score and achieve your goals

Check out our most used resource!

These accounts have the largest impact on your credit score. Use Cambio's free tools to resolve them

Even one late payment can have a large impact on your credit score. If yours are accurate, use our Goodwill template to resolve them!

Hard inquiries have a lower impact on your credit score. Learn more about how they impact you and possible ways to resolve them.

Generate your free hard inquiry dispute template now!

Takes less than 2 minutes

Generate your free collections dispute template now!

Takes less than 5 minutes

Free templates and step by step instructions

Free guide and template! Learn how to resolve your collection accounts

Takes less than 5 minutes

Works best for accounts with only a few late payments

For collection accounts that have appeared on your credit report recently (Within the last 30 days)

Get answers from Cambio experts or members who have been in your shoes.

Stay up to date on all things Cambio with product updates, announcements and more!

Vent to other Cambio members working on improving their credit scores

Credit cards often have rewards programs tied to your account. These points allow you to earn rewards based on your spending habits.

No one wants to hear that they have a debt in collections. Here are the best ways to deal with paying off a debt collector.

When lenders will offer their customers different interest rates and loan terms, this is known as risk-based pricing. This model is based on the amount of risk the consumer represents to the lender.

Everyone needs to have a credit history to help finance major life purposes. However, not everyone wants to have a credit card; here are some ways to build credit without opening a credit card.

Debt financing will allow you to raise money for your business by selling debt instruments to investors. If you are looking to start or already own a small business, debt financing can help you gain the monetary resources you need to grow.

Most people will experience some form of debt over the course of their lives. Understanding the different types of debts and how they work is critical to your financial health. The most common types of debt include secured and unsecured debt, revolving debt, and mortgages.

Buy now, pay later services allow you to split a purchase into a series of equal smaller payments. They allow you to get your item now, but spread the cost of the item out.

If you’d had a debt sent to a debt collector, be wary. Remember, do not be rushed into payments, know your rights and be sure to validate any debts.

If you are new to credit, it can be difficult to qualify for a loan. It is possible to get a loan with no credit history, but you may want to look into your other options.