Dealing With A Dreaded Collections Account

If you have looked at your credit report lately and been disappointed to find a collections account called USCB America on your credit report, you are not alone. You are just one of the thousands of unpaid debt accounts that USCB America has taken over. This means, this collection agency is going to come after you for an unpaid debt. In the meantime, their presence on your credit report will hurt your score. To rebuild your credit, read on to find out the top strategy to delete USCB America Collections accounts. We have a simple straightforward solution to help.

What is USCB America?

USCB America Collections is a debt collection agency headquartered in Los Angeles, California. They specialize in collecting unpaid medical debts for hospitals and healthcare providers. In fact, they collect unpaid debts for over 250 hospitals in the US and some of the largest healthcare providers. This agency also collects unpaid debts on behalf of banks and government municipalities.

No doubt about it, USCB America is legit. This company is a debt collector operating on behalf of companies who hired them to collect delinquent debts. So if they are contacting you, you should recognize they are not a scam and you should respond. However, there is no question that they have a very poor reputation for aggressive and questionable tactics with consumers. Make sure they don’t use those tactics with you by knowing the rules debt collectors have to follow.

Understand Your Consumer Rights

The Fair Debt Collection Practices Act protects you from harassment by collectors. Even if you owe money to a creditor, USCB America and all debt collectors must follow the regulations set by the FDCPA. Become familiar with what collections are allowed to do, and keep track of their contact with you to make sure they are staying within the boundaries.

To start, there are rules around when the agency can contact you. A debt collector can not call you outside the hours of 8am-9pm. In addition, debt collectors can’t contact you at work if you have requested that they stop. Debt collectors also cannot threaten violence or legal action.

If the debt collection agency violates your consumer rights, you can file a report with the Consumer Finance Protection Bureau.

Verify The Collections Account

As a consumer, you have the right to request debt validation within 30 days of their first contact with you. USCB America must provide proof that you are actually the account owner. For example, they can send you a copy of the original bill showing you owe the amount. Never negotiate to pay them any amount, nor claim that you own the debt, until they provide proof.

Use this free debt validation request template and mail it to:

USCB America 355 S. Grand Ave., Ste. 3200

Los Angeles, CA 90071

Dispute Inaccuracies on the Account

After you request debt validation, and USBC America verifies your account, the best practice is to review it carefully for any errors. A typical error might be the wrong amount owed. Or, the validation may report an inaccurate date that the account went into collections.

If the report shows a collection that isn’t yours, or if there are any errors, it’s in your best interest to file disputes with the credit bureaus right away. You should file disputes with all three credit bureaus: Equifax, TransUnion and Experian

Use this free template to file a dispute. Along with your dispute, don’t forget to provide evidence or documentation that proves the mistake.

Ask For a Pay For Delete

In the situation that you know you own the debt, and USBC has validated it, but you can’t pay in full, here is a tactic to try. You can negotiate a pay-for-delete or settlement. This is an agreement where a consumer offers to pay a portion of the debt in exchange for USCB deleting the account from your credit history.

If you can only afford small monthly payments toward the amount, instead of one lump sum, ask USCB America if they would be willing to change the status to “paid collections” after consistent payments. Though not ideal, paid collections is a more favorable notation on your credit report than “unpaid collections.” Of course, when working with a collections agency, get any deal in writing first.

Goodwill Letters

When you ask for removal or settlement, one tip is to include a goodwill letter explaining your financial hardship. Some consumers find this may help the collector be more inclined to work with you to resolve your debt. It never hurts to give details about what puts you in the position to not be able to pay your debt on time. In addition, you might explain how the negative mark affects your credit and prevents you from being approved for loans. Emphasize that you truly want to resolve the debt responsibly.

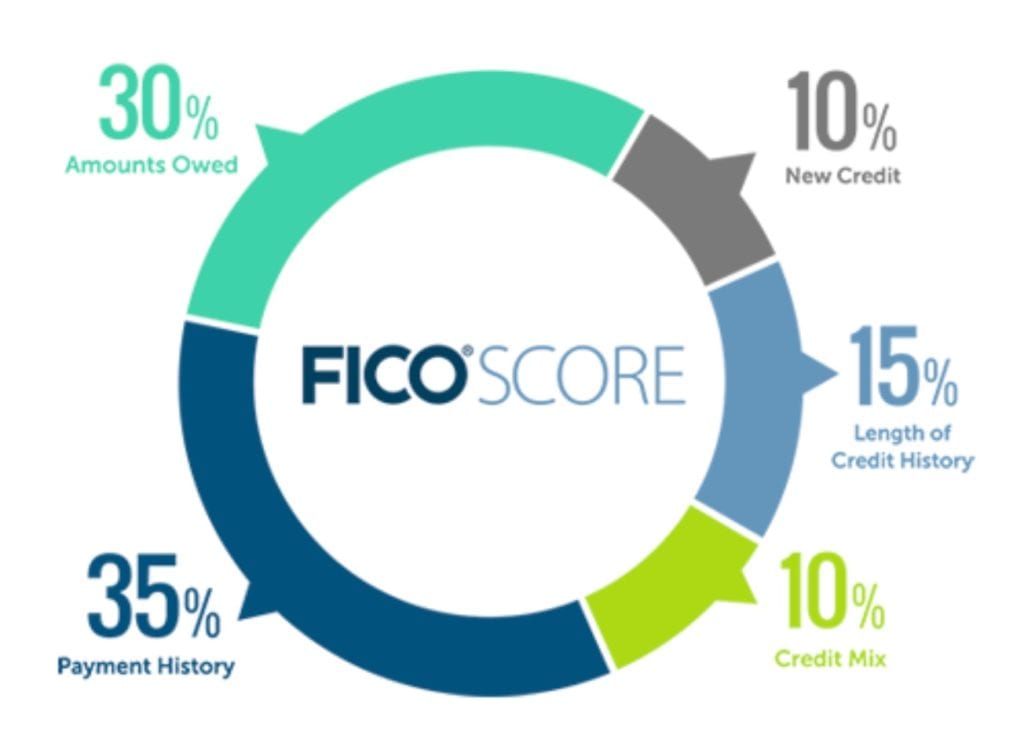

As you work to improve your credit, make sure to pay all bills on time and stay on top of debts before they go to collections. Always monitor your credit regularly and dispute errors quickly to limit damage before things affect your score.

Removing USCB America from your credit takes persistence. Through validation, disputing errors, and negotiation, you can work to get this collections account off your credit report. Get help if you’re overwhelmed– Cambio is a great place to start. And it’s absolutely worth the effort to regain your financial health. Don’t let invalid or excessive USCB marks drag you down. Take control of your credit score again.