Do you or your child require braces? We know that orthodontic care can be expensive. Considering your financing options for orthodontic care may help, but aren’t always the best solution.

The cost of braces can be shocking. According to a survey in 2018, the American Dental Association listed the average price of braces to fall between $5,000 and $6,000.

Braces and other orthodontic treatments are expensive. These out-of-pocket costs make braces inaccessible to many. And, your dental insurance plan may not even cover the cost of braces, whether that be the full amount or even part of it.

Paying for that perfect smile may have a huge impact on your finances. Your orthodontist’s office may offer you a payment plan option to make braces more accessible. However, there are many things to consider before deciding that the plan works for you.

Payment plans for braces

Braces can be extremely costly. But, often the treatment plan is well-worth the investment. Braces go further than just aesthetics, improving the ability to bite and chew food and help teeth stay cleaner.

If you are ready for braces, checking your insurance coverage first is the best plan of action, however, not all plans cover orthodontics. Having an estimate for the cost of your brace is important to extend your research about paying for braces. Your orthodontist may also offer a monthly payment plan.

However, these plans may not be the best solution if you cannot pay in full upfront.

What are my other options?

Here are some other payment options that can help spread out the cost of braces. If your insurance does not cover orthodontic care and you do not have a flexible spending account or health savings account to fall back on, there are a few other things you can consider.

Credit card

A credit card can be a great solution to spread out the cost of braces. Typically, taking on a high-interest debt is not a great idea. You can end up accruing high amounts of interest that will lead to significant financial strain.

However, some credit cards offer introductory rates with 0% APR. If you are confident you can pay the card off before the intro rate expires, this becomes a great interest free option to pay for your braces.

Personal loan

You can apply for personal loans almost anywhere, from banks, online lenders to credit unions – some even specialize in medical loans.

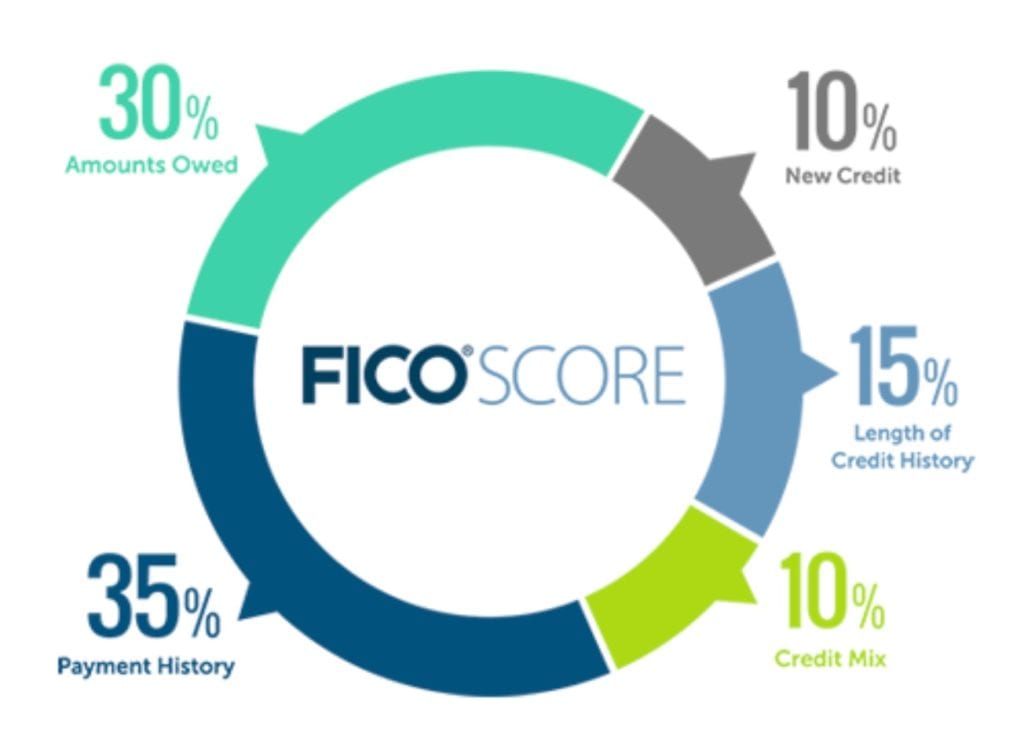

The downside to these is that they require a high credit score to qualify for a good rate, but they allow you to spread the payments out over a set period of time, such as for 24 months.

Is a payment plan a good idea?

Before deciding if a payment plan is for you, there are a few questions to consider:

- Does my orthodontist offer discounts when paying in full?

- Have I gotten multiple quotes for braces?

- Does my orthodontist offer an interest-free financing plan?

- Can I afford a monthly payment or is it more beneficial to wait?